Structuring Umbrella Funds in Luxembourg and Liechtenstein

In Luxembourg, one of the most efficient options to set up an umbrella fund is the Reserved Alternative Investment Fund (the ‘RAIF’). This type of fund is unregulated and does not require prior approval, …

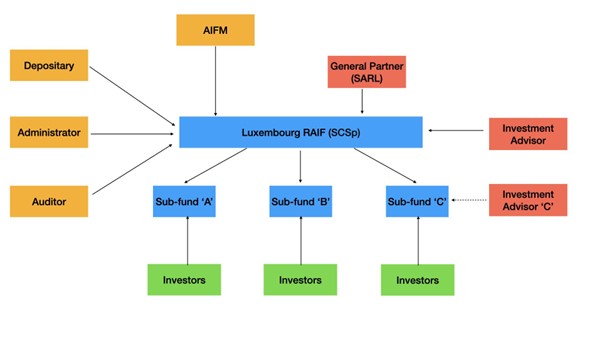

Overview:

In Luxembourg, one of the most efficient options to set up an umbrella fund is the Reserved Alternative Investment Fund (the ‘RAIF’). This type of fund is unregulated and does not require prior approval, compared to Specialised Investment Fund (SIF) and Investment Company in Risk Capital (SICAR) which also may have sub-funds. Notwithstanding the fact that the RAIF is an unregulated type of fund, Luxembourg law requires the appointment of an Alternative Investment Fund Manager (the ‘AIFM’), who should be authorized in Luxembourg or another EU state.

In order for a fund to qualify as the RAIF, a fund should meet the following criteria:

- a fund should qualify as an alternative investment fund;

- the sole object of a fund should be collective investment of its funds in assets with the aim of spreading the investment risks and giving investors the benefit of the results of the management of their assets, and

- the securities or partnership interests of a fund should be reserved for one or several well-informed investors (institutional investors, professional investors, and any investor who invest a minimum of EUR 125,000 in the RAIF), and

- the constitutive document (articles of incorporation, the management regulations, or the partnership agreement) of a fund should provide that they are subject to the provisions of the Law of 23 July 2016 on reserved alternative investment funds (the ‘RAIF Law’).

The RAIFs may be structured in several ways: as a common fund, as an investment company with variable capital (the ‘SICAV’), or as an investment company with fixed capital (the ‘SICAF’). The SICAVs and SICAFs may be established as a public limited company, a partnership limited by shares, a common limited partnership, a special limited partnership, a limited company, or a cooperative in the form of a public limited company.

The RAIF may invest in any type of assets making it a perfect solution for private equity and venture capital funds. Furthermore, the RAIF may be structured as a special limited partnership (the ‘SCSp’). This type of partnership is similar to a limited partnership established under common law. It does not have a legal personality (that means that the SCSp acts not in its own name, but through its general partner who represents the SCSp), it is treated as a flow-through vehicle for tax purposes and enjoys contractual flexibility with respect to its set-up and operation.

Formation of an SCSp:

In order to establish the RAIF in a form of the SCSp, there is a need to first register an entity that will form the SCSp and act as its general partner. A general partner may be formed as a limited liability company (SARL) with a minimum share capital of EUR 12,000.

The SCSp is established through the execution of a Limited Partnership Agreement (‘LPA’) by a general partner and a limited partner that should be recorded by a notary deed within 5 working days after the establishment.

The LPA of the SCSp should include, inter alia, a statement that the SCSp is subject to the RAIF Law. Furthermore, in order to establish an umbrella RAIF, an LPA should expressly provide for the possibility of compartments (sub-funds) creation and provide operational rules for compartments (sub-funds).

Within 15 working days, after an LPA is recorded by a notary deed, a notice to the register of commerce and companies should be submitted regarding the constitution of the RAIF, in order to be published by the official electronic platform. The notice should also indicate the AIFM which will manage the fund and whose name will be also published on the platform.

Luxembourg law also prescribes that a subscribed capital of the RAIF should be not less than EUR 1,2 million which should be reached within a period of twelve months following its constitution.

Service Providers:

Operation of the RAIF requires the appointment of certain service providers. One of them is the AIFM. In order to manage the RAIF, the AIFM should be authorized in Luxembourg or other EU states. This means that registered AIFMs that benefit from de minimis exemption may not manage the RAIF.

The AIFM is responsible for the management of the RAIF, proper valuation of its assets, calculation of NAV, marketing of fund units, and other functions. This article does not aim to provide a regulatory regime of the AIFM. If you are interested in the establishment of your own fund manager, we can also provide services regarding its formation and authorization.

Furthermore, there must be appointed a depositary who performs functions of safe-keeping of the fund’s assets. Its registered office should be in Luxembourg or it should have a branch there if its registered office is in another EU state. And an auditor who is responsible for the audit of the RAIF’s accounting information presented in its annual report.

Regulation of Compartments (Sub-Funds):

The RAIF Law allows the creation of compartments (sub-funds) within its structure. Each compartment corresponds to a distinct part of the assets and liabilities of the RAIF and the rights of investors and of creditors concerning a compartment are limited to the assets of that compartment. This means that the assets of a compartment may be only used to satisfy the rights of investors in relation to that compartment.

Operation and establishment of compartments are regulated by constitutive documents of the RAIF that should expressly provide for the possibility of compartments establishment. Furthermore, offering documents of the RAIF (or its particular compartment) should describe the investment policy of each compartment.

Each compartment may have its own investment policy, offering documents, annual report, and investment advisor. However, the RAIF should appoint the same AIFM, depositary, auditor, and administrator for all of its compartments.

Furthermore, the RAIF law allows the creation of different types of sub-funds (closed-ended and/or open-ended) within a single structure of the umbrella fund.

Liechtenstein:

Overview:

Liechtenstein law provides for the possibility of the establishment of umbrella funds in a form of alternative investment funds (the ‘AIF’).

The AIF is defined as a collective investment undertaking, including sub-funds thereof which:

- raises capital from a number of investors with a view to investing for the benefit of these investors in accordance with a defined investment strategy; and

- is not a UCITS (as defined in the Liechtenstein UCITS Act) nor an investment undertaking (as defined in the Liechtenstein Investment Undertakings Act).

The AIF may be formed as an investment fund (constituted under the law of contracts), as a trust, as an investment company (public limited company or European company), and as a partnership (investment limited partnership and investment partnership of limited partners).

The most common form of the AIF is an investment limited partnership (the ‘ILP’), which is similar to a special limited partnership (the ‘SCSp’) in Luxembourg and a limited liability partnership in common law jurisdictions. In this article, we will assess the formation and operation of the AIF umbrella fund in the form of the ILP.

Formation of an Investment Limited Partnership:

The AIF in a form of the ILP is formed upon registration in Liechtenstein commercial register. In order to register the ILP, a general partner should make an application for registration. The formation and operation of the ILP are governed by the Law of 19 December 2012 concerning the Managers of Alternative Investment Funds (the ‘AIFM Law’) and rules contained in the Law on Persons and Companies (PGR) in respect to a limited partnership.

There is no need to apply for authorization from the Financial Market Authority (the ‘Regulator’) for the AIF, however, the alternative investment fund manager (the ‘AIFM’) of the AIF should notify the Regulator about the AIFs it manages and provide certain information about them, including, investment strategy, the constitutive documents, information about depositary and other. Moreover, the AIFM should notify the Regulator about its intention to market the AIF. Such notification should include almost the same information plus a description of the measures to prevent the marketing of AIFs to non-professional investors and a description of the information available to investors.

The ILP is governed by a partnership deed that governs the operation of the ILP and the rights of its investors. The AIFM Law provides for the list of rules that should be stated in the partnership deed, including rules on transferability of the limited partner’s interest, rules on the commercial purpose of the investment, and the management of the assets in accordance with established investment policies and investment goals, rules on the duration of the partnership and other.

Furthermore, Liechtenstein law provides that the assets of the AIF should be no less than EUR 1,25 million and this amount should be achieved within one year from authorization of the AIFM or after marketing of the AIF is commenced. In case such an amount is not reached within the prescribed time limit the AIF should be wound up.

Service Providers:

Similar to Luxembourg law, the operation of Liechtenstein AIF, requires the appointment of certain service providers.

One of the main service providers is the AIFM. It should be an entity authorized to provide fund management services in Liechtenstein or another EU state. However, under Liechtenstein law it is possible to operate the AIF on the basis of registration of fund manager rather than authorization. This option is available where the total assets under management of such a fund manager do not exceed EUR 500 million and the rules of the AIFs under management do not provide for the use of leverage and redemption rights (for a period of five years).

Other service providers necessary for the operation of AIF are the same as for the Luxembourg RAIF, namely the depository and auditor who should be authorized or registered.

Regulation of Sub-Funds:

Liechtenstein law provides for the possibility of establishing a sub-fund within the structure of the AIF. The principles on which sub-funds operate are similar to Luxembourg (and other jurisdictions), meaning that claims of investors and creditors directed against a particular sub-fund are restricted to that sub-fund, and assets of one sub-funds may not be used to discharge the obligation of another sub-fund formed within the structure of the same AIF.

In order to establish sub-funds within the structure of the AIF, constituent documents of the AIF should provide for the possibility of sub-fund formation. There are no restrictions on the forms of the AIFs that may create sub-funds. Furthermore, it is possible to have several or just one sub-fund within the structure of the AIF.

Under Liechtenstein law, each sub-fund is treated as a separate AIF and separate accounts shall be held for each sub-fund. Furthermore, each sub-fund should appoint its own depositary (who may be the same as for other sub-funds or different).